Packaging Education, Plastic Packaging

Everything You Need To Know About The Plastic Packaging Tax

Plastic packaging comes with pros and cons however, the main concern at this current time would be the reduction of plastic waste, which is affecting our global environment. The UK Government has introduced a plastic tax that will be implemented from April 2022. This new tax will drive all plastic products to contain at least 30% recycled plastic material, known as PCR (Post Consumer Regrind), in the plastic packaging industry.

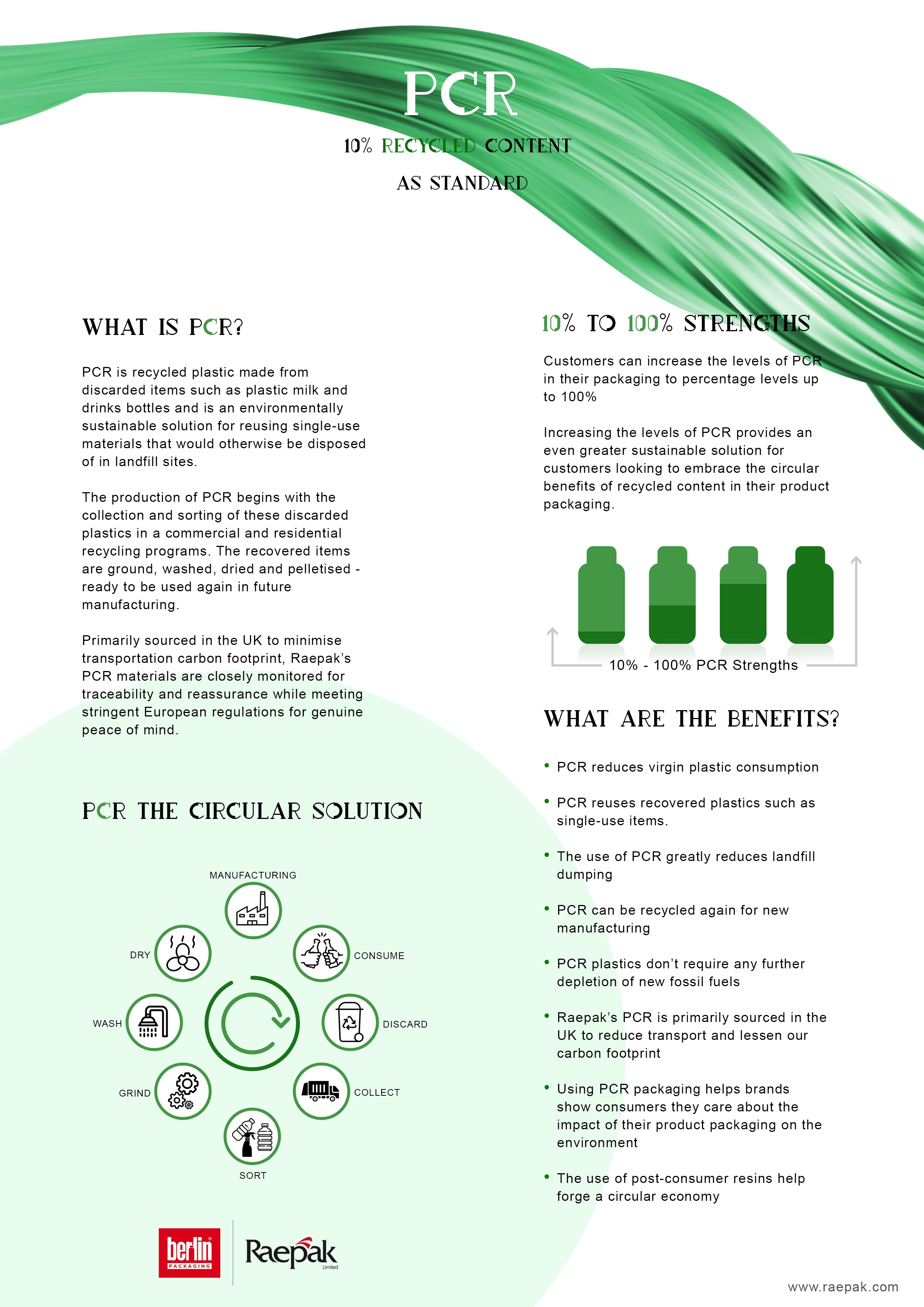

What Is PCR Plastic?

PCR is a blend of recycled plastic products that can be collected through the circular economy. Local councils collect plastics from domestic and commercial properties, and these plastics can be broken down (washed) to produce a material that can be used as part of new plastic products. UK plastic waste is also shipped abroad to countries that can use this scheme to sell PCR plastic back to foreign manufacturers. This process makes the recycling model a better fit for sustainability as the importing of plastic products also needs to contain 30% recycled plastic. If these percentages are met, the plastic tax can be avoided.

Who Does The Plastic Tax Effect?

Plastic tax will affect everyone, especially the consumer who buys plastic packaging in the future. If a brand or company decide to use 100% (raw plastic), the plastic packaging price points will be passed down to the end buyer (consumer).

Are you on the list?

- UK producers of plastic packaging

- Importers of plastic packaging

- Business customers of producers and importers of plastic packaging

- Consumers who buy goods in plastic packaging in the UK

- Producers and importers of small amounts of plastic packaging to mitigate against disproportionate administrative burdens in comparison to the tax liability.

Sustainability And Legislation

The importation of plastic packaging will be taxed on unfilled or filled containers, which will be launched alongside the UK Government Budget. A 30% increase in price promotes a clear incentive to all businesses using plastic packaging. Furthermore, this will help with the growing emphasis on recycling waste, sustainability and less waste for landfills. The current law will change to incorporate legislation for a Plastic Packaging Tax. Additionally, the Finance Act 2020 contains legislation that enables HMRC to spend on costs associated with the development of the tax, particularly the development of the IT system to support this new tax.

The key features of the 2021 finance bill for Plastic Packaging Tax, including:

- £200 per tonne tax rate for packaging with less than 30% recycled plastic

- Registration threshold of 10 tonnes of plastic packaging manufactured in or imported into the UK per annum

- The scope of the tax by definition of the type of taxable product and recycled content

- Exemption for manufacturers and importers of small quantities of plastic packaging

- Who will be liable to pay the tax and need to register with HMRC

- How the tax will be collected, recovered and enforced

- How the tax will be relieved on exports

Who Can Help?

Berlin Packaging UK has already anticipated the levy on plastic packaging import and export costs. Our policy offers sustainable products that support brands, wholesalers, commercial and domestic companies that use plastic in their products. We have already developed a range of fully recyclable containers and PCR plastic options to use 30% recyclable material. As a hybrid global leader in the packaging industry, we welcome the new Government policy as it works directly with our sustainable principles for a safer and healthier environment.

PCR Plastic Fact Sheet